CASE STUDY

How Pharma needs to improve, according to patient groups in Asia-Pacific

December 2024:

A new systematic analysis from PatientView identifying specific strategic steps that pharma needs to take to improve its reputation.

PatientView’s annual ‘Corporate Reputation of Pharma’ assesses the performance of individual companies, according to ten indicators defined by patient groups as important. Now, companies can identify how to improve their performance against each core indicator.

By examining the feedback provided by patient groups to PatientView’s ‘Corporate Reputation of Pharma’ survey, a better idea can be obtained of the strategic direction companies need to take to improve their reputation— all defined by the patient groups themselves. To support this exercise, PatientView has developed a new toolkit, ‘Moving Forward’, which uses a thematic analyses (defined by priorities identified from patient group comments) to develop strategic guidance for companies seeking to improve their corporate reputation and patient-group relations.

Use Moving Forward to help your company address patient-group priorities

Considering Asia-Pacific as a case study:

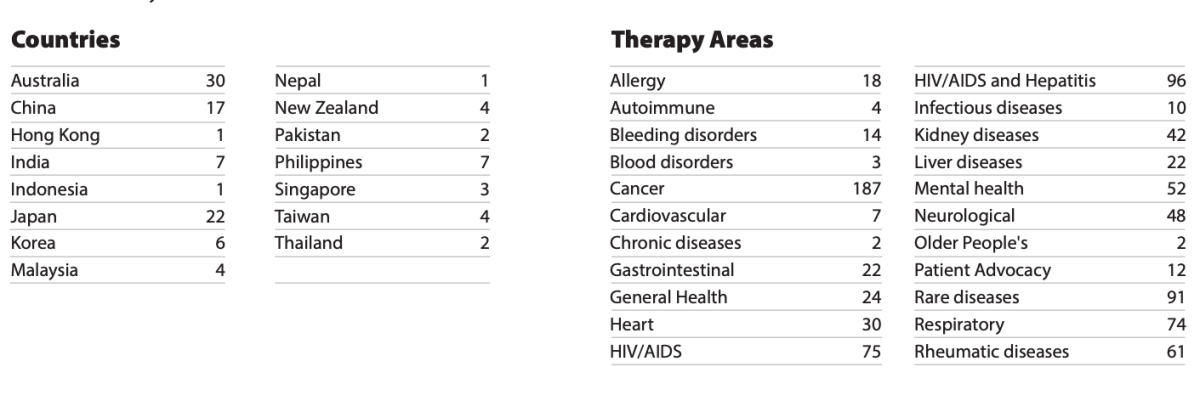

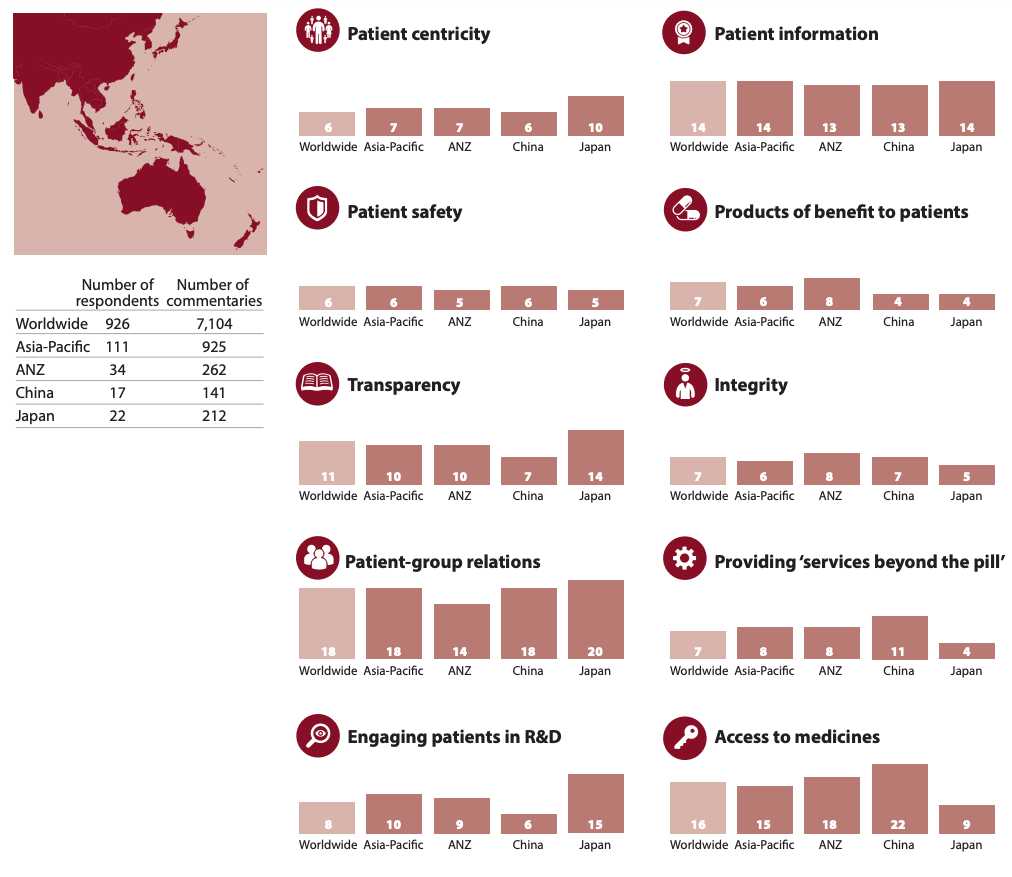

111 respondent patient groups from the Asia-Pacific region provided 945 commentaries to the 2023/24 PatientView ‘Corporate Reputation of Pharma’ survey

Comparing the priorities of patient groups: worldwide; Asia-Pacific; ANZ; China; and Japan

The percentage of patient-group commentaries in each geographic region identifying a specifi c pharma activity (corporate-reputation indicator) needing improvement.

Examples of the top strategic priorities for pharmaceutical companies, as expressed by patient groups from Asia-Pacific

The 945 commentaries provided by the 111 respondent Asia-Pacific patient groups are also categorised according to content, with each category linked to the most relevant of the 10 indicators of corporate reputation. Categories help define more precisely what actions pharma companies need to take to support their Asia-Pacific patient-group partners.

Asia-Pacific

| Top Indicator needing attention

18% of the 945 commentaries provided by respondent patient group from Asia-Pacific stated that pharma needs to improve its patient-group relations. |

Top Category for indicator

Six categories define the broad range of activities involved in patient group relations. Most cited by the AsiaPacific patient groups is category # 29: Sustain quality long-term support for patient groups. |

Action plan # 29 – Sustain quality long-term support for patient groups

Look to avoid long, complex contract arrangements that the partner patient group will find time consuming and burdensome to process. Make sure that the amount of time any patient group has to spend applying for funding from the company is worth the benefits the patient group will gain from the funding. Whenever possible, consider how to ensure in the relationship the patient-group’s stability of funding from the company. As part of this process: • Favour medium- to long-term (rather than short-term, or piecemeal) funding; • Aim to fund patient-group projects likely to positively impact patients; and also • Look for patient-group projects that further the patient group’s own patient-oriented goals. Example comment from a rheumatic-diseases patient group, Australia: “Understanding that patient groups are also run as a business (profit for purpose), with a specific mission-driven objective (to support consumers), and recognise that this costs money to do so. Stop expecting not for profits to provide valuable information and access to consumer insights and support, for little-to-no support. Build professional working relationship[s] that are transparent, mutually beneficial, and have impact.” |

ANZ

| Top Indicator needing attention

18% of the 262 commentaries provided by respondent patient groups from ANZ stated that pharma needs to improve access to medicines. |

Top Category for indicator

Eight categories define the broad range of activities involved in improving access to medicines. Most cited by the ANZ patient groups is category # 48: Improve speed/quality of HTA and approvals. |

Action plan # 48 – Improve speed/quality of HTA and approvals

Retain high standards of pharmacovigilance, while • Accelerating HTA, insurer, payor, and regulatory approvals. • Helping to keep patient views and priorities at the centre of the approvals process. For example: • Balancing company investment in local clinical research, and in market-access solutions, between high-, medium-, and low-income countries. • Demonstrating to regulators how patients have been involved in R&D, and in commercialisation decisions—from identifying priority unmet needs, onwards. • Involving all stakeholders early on in the research process, with the aim of enabling speedier approvals. Example comment from a patient group specialising in general health issues, Australia: “Work within HTAi [Health Technology Assessment International] guidelines.” |

China

| Top Indicator needing attention

22% of the 141 commentaries provided by respondent patient groups from China stated that pharma needs to improve access to medicines. |

Top Category for indicator

Eight categories define the broad range of activities involved in improving access to medicines. Most commonly cited by the Chinese patient groups is category # 44: Enable affordable pricing. |

Action plan # 44 – Enable affordable pricing

Focus on affordability throughout the development and commercialisation of a treatment, to help make treatments more affordable for healthcare systems, insurers, or individual patients. Be open to drug-pricing reforms, and to innovative pricing models requested by patient groups and healthcare systems. Example comment from a rheumatic-diseases patient group, China: “Improve drug access in urban and rural areas, ensuring that products reach the patients who need them, and letting them access and afford the medicines they need.” |

Japan

| Top Indicator needing attention

20% of the 212 commentaries provided by respondent patient group from Japan stated that pharma needs to improve its patientgroup relations. |

Top Category for indicator

Six categories define the broad range of activities involved in patient group relations. Most commonly cited by Japanese patient groups is category # 28: Enable effective two-way communication with patient groups. |

Action plan # 28- Enable effective 2-way communication with patient groups

Once a relationship with a patient group is initiated, that relationship needs to be kept alive and productive, with regular, personal, two-way contact. For example: • Aim to keep in place, for as long as possible, a dedicated point of contact with the patient group. • Build two-way communication (such as virtual webinars) into all of the company activities that involve the patient group. • Respond quickly to questions and requests from the patient group. • Connect the patient group with the most-appropriate contacts within the company. Example comment from a respiratory patient group, Japan: “There should be more active exchanges of information. Participation in lectures and exchange meetings held by patient groups. Hold periodic, and timely, information-exchange meetings. Hold meetings to provide explanations of new drug launches to patients (it will be fine if these are only attended by executives), or provide notification of such meetings. Comparisons of adverse reactions in Japan and in foreign countries, and make suggestions of how likely these are to occur with similar drugs.” |